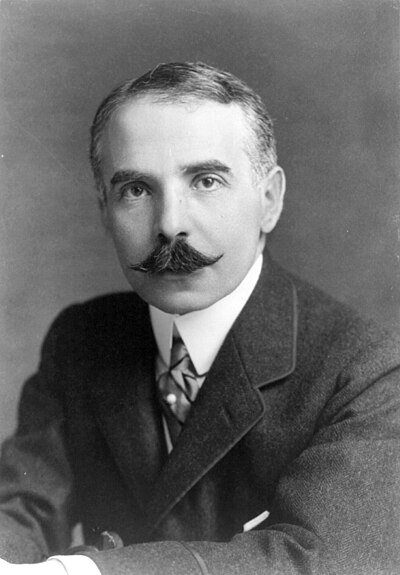

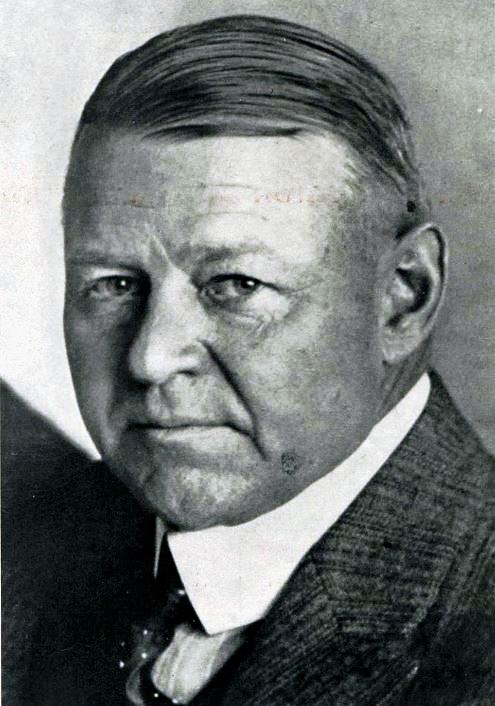

Irving Fisher

Irving Fisher was an influential American economist and statistician known for his pioneering contributions to economic theory and policy. As one of the earliest neoclassical economists in the United States, he made significant advancements in utility theory and general equilibrium, laying the groundwork for modern economic thought. Fisher's work on intertemporal choice and his development of theories related to capital and interest rates were groundbreaking, and he is credited with initiating the monetarist school of macroeconomic thought through his research on the quantity theory of money. His concepts, such as the Fisher equation and the Fisher hypothesis, remain integral to economic discourse today. Despite his substantial contributions, Fisher's reputation suffered after he famously declared the stock market had reached a 'permanently high plateau' just days before the 1929 crash. His later theories on debt deflation, which sought to explain the Great Depression, were overshadowed by the rise of John Maynard Keynes. However, Fisher's ideas experienced a resurgence in the late 20th century, particularly as economists began to revisit his models in light of new economic challenges, including the Great Recession. His legacy endures as a testament to the complexities of economic forecasting and the evolution of economic theory, cementing his status as a pivotal figure in the history of economics.

Famous Quotes

View all 3 quotes“As a matter of fact, what investment can we find which offers real fixity or certainty of income? ... As every reader of this book will clearly see, the man or woman who invests in bonds is speculating in the general level of prices, or the purchasing power of money”

“How much there is I want to do! I always feel that I haven't time to accomplish what I wish. I want to read much... I want to write a great deal. I want to make money!”

“A bond price, for example, will grow with accrued interest between two coupon cuttings. That growth in its value is not income but increase of capital. Only when the coupon is detached does the bond render, or give off, a service, and so yield income. The income consists in the event of such off-giving, the yielding or separation, to use the language of the United States Supreme Court. If the coupon thus given off is reinvested in another bond, that event is outgo, and offsets the simultaneous income realized from the first bond. There is then no net income from the group but only growth of capital. If the final large payment of the principal is commonly thought of not as income (which it is if not reinvested) but as capital it is because it is usually and normally so reinvested.”